SEC Adopts Final Rules Regarding Share Repurchase Disclosure

On May 3, 2023, the U.S. Securities and Exchange Commission (“SEC”) adopted final rules requiring (1) issuers to disclose daily quantitative repurchase data at the end of every quarter in their Form 10-Qs and 10-Ks, (2) foreign private issuers (“FPIs”) to disclose daily quantitative repurchase data at the end of every quarter on a new Form F-SR within 45 days after the end of an FPI’s fiscal quarter, (3) issuers to include in Form 10-Qs and 10-Ks, and FPIs to include in Form 20-Fs, narrative disclosure on the objectives and rationale for share repurchases and the process or criteria used to determine the amount of repurchases, as well as any policies or procedures relating to purchases and sales of the issuer’s securities by its officers and directors during a repurchase program, and (4) issuers to include in Form 10-Qs and 10-Ks disclosure regarding an issuer’s adoption and termination of Rule 10b5-1 trading plans. The final rules vary from the proposed rules issued by the SEC in 2021, with the most significant variance being the requirement for quarterly reporting of daily repurchase transactions instead of daily reporting following each repurchase.

Background

Since 2003, the SEC has required disclosure regarding share repurchases in an issuer’s periodic reports, including the number of shares repurchased on a monthly basis, the average price per share, the total number of shares purchased as part of a repurchase plan or program, the maximum number of shares or approximate dollar value that may be purchased under existing plans or programs and footnote disclosures regarding the principal terms of publicly announced repurchase plans.

In December 2021, the SEC issued proposed rules to supplement these requirements. In proposing the rules, Chairman Gensler and the SEC expressed concerns that, without additional disclosure, market participants are not made aware of the details and motivations surrounding share buybacks. The proposed rules were more cumbersome in several ways than the recently finalized rules. For example, the proposed rules included a new form to be filed within one business day of share repurchases, disclosing the date and number and class of shares purchased, among other things. With respect to share repurchase plans, the proposed rules also required a checkbox indicating whether any of the issuer’s Section 16 officers or directors purchased or sold shares within 10 business days before or after the announcement of such plan or program.

Periodic Report Share Repurchase Disclosure Requirements

- Share Repurchase Disclosures for Issuers

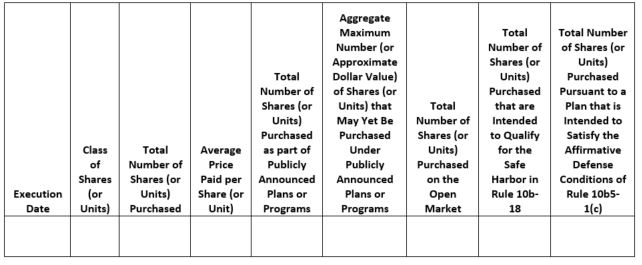

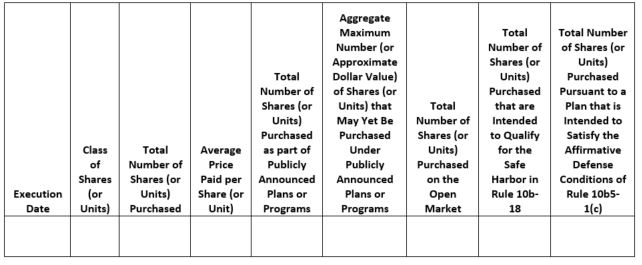

- New Table Requirement. The final rules add a new Item 601(b)(26) to Regulation S-K and require the exhibit called for in this Item to be included in Form 10-Qs and Form 10-Ks. This new Item requires a table in the form set forth below:

This tabular information must be provided on a daily basis for the period covered by the report (or the issuer’s fourth quarter in a Form 10-K). In addition, issuers must disclose, by footnote to the table, the date of adoption or termination of any repurchase plan that is intended to satisfy the affirmative defense conditions of Rule 10b5-1(c) with respect to shares listed in the furthest right column of the table. The information provided must also be reported in Inline XBRL format.

- New Form F-SR. Every FPI that has a class of equity securities registered pursuant to Section 12 of the Securities Exchange Act of 1934 (the “Exchange Act”) and that does not file reports on Form 10-Q or Form 10-K must file a Form F-SR quarterly, which will disclose, for the period covered by the form, the same information as required in the table now required for Item 601(b)(26) for issuers that file reports on Form 10-Q and 10-K. This disclosure must also be reported in Inline XBRL format.

- Checkbox Requirement for Certain Directors and Members of Senior Management. Similar to the checkbox prescribed by Item 601(b)(26), the Form F-SR will require that FPIs indicate by checkbox whether any director or member of senior management who would be identified pursuant to Item 1 of Form 20-F purchased or sold shares that are the subject of a publicly announced issuer repurchase plan or program within four business days before or after the issuer announced a repurchase plan or program or an increase thereto. In determining whether to check this box, the final rules state that an FPI may rely on written representations from the directors and senior management who would be identified pursuant to Item 1 of Form 20-F, provided that such reliance is reasonable.

Narrative Disclosure Requirements Regarding Share Repurchases

- Amendments to Item 703 of Regulation S-K

- The final rules amend Item 703 of Regulation S-K to require a narrative disclosure in Form 10-Qs and 10-Ks with respect to share repurchases disclosed under the new Item 601(b)(26) discussed above. This narrative disclosure must describe (1) the objectives or rationales for each repurchase plan or program and the process or criteria used to determine the amount of repurchases, (2) the number of shares purchased other than through a publicly announced plan or program, and the nature of the transaction (e.g., whether the purchases were made in open-market transactions, tender offers or other transactions), (3) for publicly announced repurchase plans or programs, the date on which the plan or program was announced, the dollar or share amount approved, the expiration date of the plan or program, each plan or program that expired during the period covered by the tabular disclosure and each plan or program the issuer has decided to terminate prior to its expiration or under which the issuer does not intend to make further purchases, and (4) any policies and procedures relating to purchases and sales of the issuer’s securities by its officers and directors during a repurchase program, including any restrictions on such transactions. This disclosure must also be reported in Inline XBRL format.

- Current Item 703(a) of Regulation S-K requires issuers to provide repurchase information on a monthly basis in tabular format in their Form 10-Qs and 10-Ks. As a result of the new disclosure requirements, this monthly repurchase information will no longer be required and is removed by the amendments to Item 703.

- The final rules also amend Form 20-F to require narrative disclosure equivalent to that mandated by the amendments to Item 703 in Form 20-Fs for FPIs. This disclosure must also be reported in Inline XBRL format.

Insider Trading Plan Disclosures

As a reminder, in December 2022, the SEC adopted final rules regarding Rule 10b5-1 trading plans and the disclosure of insider trading policies. At that time, the SEC did not adopt a proposal to require corresponding disclosure regarding the use of Rule 10b5-1 trading plans by an issuer. However, the final rules now include a new Item 408(d) of Regulation S-K to require issuers to disclose in their Form 10-Qs and 10-Ks (1) whether, during the period covered by the filing (the issuer’s fiscal fourth quarter in a Form 10-K), the registrant adopted or terminated a Rule 10b5-1 trading plan, and (2) a description of the material terms of any Rule 10b5-1 trading plan, such as the date it was adopted, the plan’s duration and the number of shares to be bought and sold under the plan. The final rule does not require issuers to disclose pricing information regarding Rule 10b5-1 trading plans. This disclosure must also be reported in Inline XBRL format.

Timing of Effectiveness of the Final Rules

All issuers other than FPIs will be required to comply with the new disclosure requirements, as well as Inline XBRL requirements, in their Form 10-Qs and 10-Ks beginning with the first filing that covers the first full fiscal quarter beginning on or after October 1, 2023. For issuers with a calendar fiscal year, this means incorporating the new disclosures in their fiscal 2023 Form 10-Ks, filed in 2024.

For FPIs, the new Form F-SR disclosure and Inline XBRL requirements begin with the first full fiscal quarter that begins on or after April 1, 2024, and the corresponding narrative disclosure and Inline XBRL requirements for Form 20-F begin with the first Form 20-F filed after the first Form F-SR has been filed.

Recommended Actions

- Given the current public discourse surrounding share repurchases, we expect the SEC to continue to focus on share repurchases, as well as insider trading and the use of trading plans pursuant to Rule 10b5-1. In light of the final rules, issuers and their directors and officers should consider the following recommended actions:

- Issuers should review, formalize and update their policies and procedures for cataloging their share repurchases and, if they do not do so already, ensure these procedures track trades on a daily basis. Issuers should contact their brokers and banks early to coordinate these efforts.

- Due to the new checkbox requirement, issuers should similarly review and/or establish processes for tracking trades made by their directors and Section 16 officers around times share repurchase plans are adopted, amended or terminated by the issuer. Issuers might also consider revising their insider trading policies and/or practices regarding the imposition of special blackouts to include restrictions regarding trading within 4 business days of an announcement regarding a repurchase program.

- Issuers must also begin preparing the new required narrative disclosures. In doing so, boards and management should consider including a discussion regarding the objectives or rationales for the issuer’s share repurchases and the process or criteria used to determine the amount of repurchases approved in the issuer’s records, and should ensure public disclosures are consistent with these records.

- If terminating a Rule 10b5-1 plan or a share repurchase program in connection with an acquisition or other material event, because an issuer would have to disclose that termination in its next quarterly or annual filing, issuers should be mindful of the possibility that investors will be curious about what led to the termination, which could lead to speculation and stock price fluctuations or pressure to disclose the reason for the termination sooner than would otherwise be expected.

- Jason M. Hille

- Austin R. Kissinger

- Jessica S. Lochmann

- John K. Wilson